I few weeks ago I wrote “An Unfair Evaluation of Biden Economic Policies.” The “unfairness consisted in judging the policies against my idea of (near) perfection, not as the outcome of conflicts among real live politicians who unfortunately do not all share my ideas of perfection.

Now Noah Smith invites us to Evaluate Kamala Harris’s Entire Economic Policy Program. His evaluation is much fairer as he judges it for bad things it leaves out (a lot of Warren-Sanders stuff), marginal movement in positive directions, and particularly as a political document in contrast with Trump program.

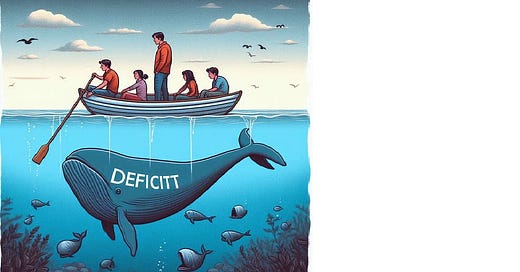

I agree with the assessment with a blue whale sized nuance: tax revenues.

Unless the Harris administration has some ideas for net spending reduction I have not heard, (farm subsidies? some kinds of CO2 emissions reduction subsidies? but increases in defense and a child allowance) the program needs to be much more ambition on raising tax revenue. [Just allowing the Trump-Ryan “Tax Cuts for the Rich and Deficits Act of 2017” expire is not enough.] Deficits in practice are much higher than = Σ(expenditures with NPV>0), so they (the combination of taxes and expenditures that make them up) shift resources from investent to consumption and that's bad for growth. Shifting from taxing income toward taxing consumption would be an additional benefit.

In addition, dealing with climate change is likely to increase the need for investment both for mitigation (investments in solar nuclear, wind, geothermal CCS) and adaption (building more weather hardened Ashville and hundreds of thousands of similar instances). If these investments come at the expense of others (i.e. if they add to deficit financing), this will slow growth.

Furthermore, there is a strong moral argument for rich countries (including but not exclusively the US) who have benefitted disproportionately from historic CO2 emissions to aid poorer countries to adapt to the effects of the CO2 mainly they (we) have put into the atmosphere. Again, if these resources are removed from investment, growth suffers.

It should go without saying that a tax on net emissions of CO2 is a deficit reducing response to these revenue needs, independent of its incentive effects on reducing future emissions.

Oh, did I mention that deficits attract foreign capital Inflow which pushes up the value of the dollar and does no favors for manufacturing output that Noah likes.

In sum, we need serious reduction in growth-suppressing fiscal deficits and that almost certainly will have to be achieved with much higher revenues.

Another, merely Mastodon -size nuance, is immigration. Next to deficit reduction, a large increase in merit-based immigration is the most important growth-promoting policy. We need to get away from the notion that immigration benefits only immigrants. [Sure, we should be proud of having provided refuge to victim of political repression and natural disaster, but like others, these immigrants, too, contribute to the economy and society.] In a basically capitalistic economy like the US, every economic transaction between an immigrant and a non-immigrant -- receiving a wage, paying rent, buying groceries, paying taxes -- is _mutually_ beneficial to immigrant and non-immigrant.

[Standard bleg: Although my style is know-it-all-ism, I do sometime entertain the thought that, here and there, I might be mistaken on some minor detail. I would welcome comments on these views.]

Image Prompt: people in a rowboat unaware of the deficit whale swimming beneath them.

"did I mention that deficits attract foreign capital Inflow which pushes up the value of the dollar and does no favors for manufacturing output that Noah likes."

Thomas, I mentioned this question on one of your comments on a Noah post some days ago but I don't think you saw it.

Your macro is far better than mine. How much do you think this is really happening to the USD today? Macro theory says that large trade imbalances and large deficits should both cause a currency to appreciate, and yet our trade deficit has run about 3% annually and our govt deficit has tripled in the last 10 years with little effect on our currrency.

The preppers all think we're standing on an economic ice shelf that's ready to collapse, but my grandfather thought the same thing from 1975 until he died 20 years later. Is the theory wrong? Am I wrong about what is says? Is it just a case of "in the long run we're all dead"? Are we being insulated by our reserve currency status? By something else?

Unfortunately a carbon tax seems to be completely impossible to accomplish, as a matter of politics. I completely agree that if you want to reduce the deficit (which we should) a carbon tax is a better choice in theory than almost anything else. I am a metaphorical card-carrying member of the Pigou Club. But AFAIK everywhere that has tried to impose a reasonable version -- high enough to actually make a difference -- has seen the public revolt. (The notable examples I know of are Australia, where rejection of the carbon tax was part of what swept in a truly terrible rightist government, and Washington state in the US.)

Some kind of cap-and-trade (either annual auctions, or permanent tradable permits that have a small annual fee attached, and that "shrink" over time as the cap comes down) seems like it might more plausibly be accomplished, and arguably is a better idea, since it allows the actual price to float to whatever level will accomplish the appropriate quantity reduction, and science is better equipped to estimate the relationship between the quantity of emissions and impact on climate, than to guess at what price will be necessary to accomplish a given amount of reductions. Maybe use the money for a mix of deficit reduction and rebates, to buy public support. (California does an annual climate rebate, and while it doesn't help with folks who are actively climate denialists, it does seem to help with the broad middle of low-information voters, and it seems like getting low-info people to broadly agree that climate change _is a thing_ helps make GOP deniers look crazy, hence helping to maintain California's Dem super-majority. Of course if the GOP wanted to embrace folks like Steve Poizner and move back to the center, I'm sure they could significantly cut into that super-majority. But so far the whole party has just kept driving out its moderates, marching ever farther off into Cloud Cuckoo Land.)